Home Insurance Costs Are Rising: What Buyers in Sarasota and Lakewood Ranch Should Plan For

Darren Dowling

Darren Dowling

Buying a home is one of the largest financial decisions you’ll ever make and homeowner’s insurance plays a critical role in protecting that investment. For buyers across Sarasota, Lakewood Ranch, Manatee County, and Charlotte County, insurance costs have become an increasingly important part of the homebuying conversation.

Homeowner’s insurance acts as a financial safety net. According to NerdWallet, it generally:

Covers repairs and rebuilding costs if your home is damaged by fire, storms, or other covered events

Protects your personal belongings, including furniture, electronics, jewelry, and clothing

Provides liability coverage if someone is injured on your property and medical or legal expenses arise

That protection brings peace of mind but in recent years, it has also come with higher costs.

Home insurance premiums are rising nationwide, and Florida markets like Sarasota and Lakewood Ranch are no exception. According to the Insurance Research Council (IRC), several key factors are driving these increases.

Severe weather events and natural disasters are occurring more frequently, leading to a higher volume of insurance claims. At the same time, construction materials and labor costs have risen significantly. When insurers pay out claims, the cost to repair or rebuild homes in Manatee and Charlotte County is much higher than it was just a few years ago.

These factors combined have pushed premiums upward year over year.

The good news is that while premiums are still rising, the pace of those increases may be starting to slow.

According to ResiClub and Cotality:

In 2023 and 2024, insurance costs increased by about 14% per year

In 2025, the increase was closer to 10%

In 2026 and 2027, increases are projected to average around 8% annually

That’s still an upward trend, but it suggests the sharpest jumps may be behind us.

There is another factor working in buyers’ favor. While insurance premiums have climbed, mortgage rates have been trending downward. Lower rates can help offset some of the added monthly expense from insurance.

As Michael Gaines, Senior VP of Capital Markets at Cardinal Financial, explains:

“Rising taxes and insurance do create pressure, but they don’t erase the benefits of a lower rate. A small rate improvement, paired with the right loan program and smart planning, can still make homeownership possible. It’s less about one factor canceling another out and more about layering the right solutions together.”

For buyers in Sarasota and Lakewood Ranch, this balance between interest rates and insurance costs is an important part of long-term affordability.

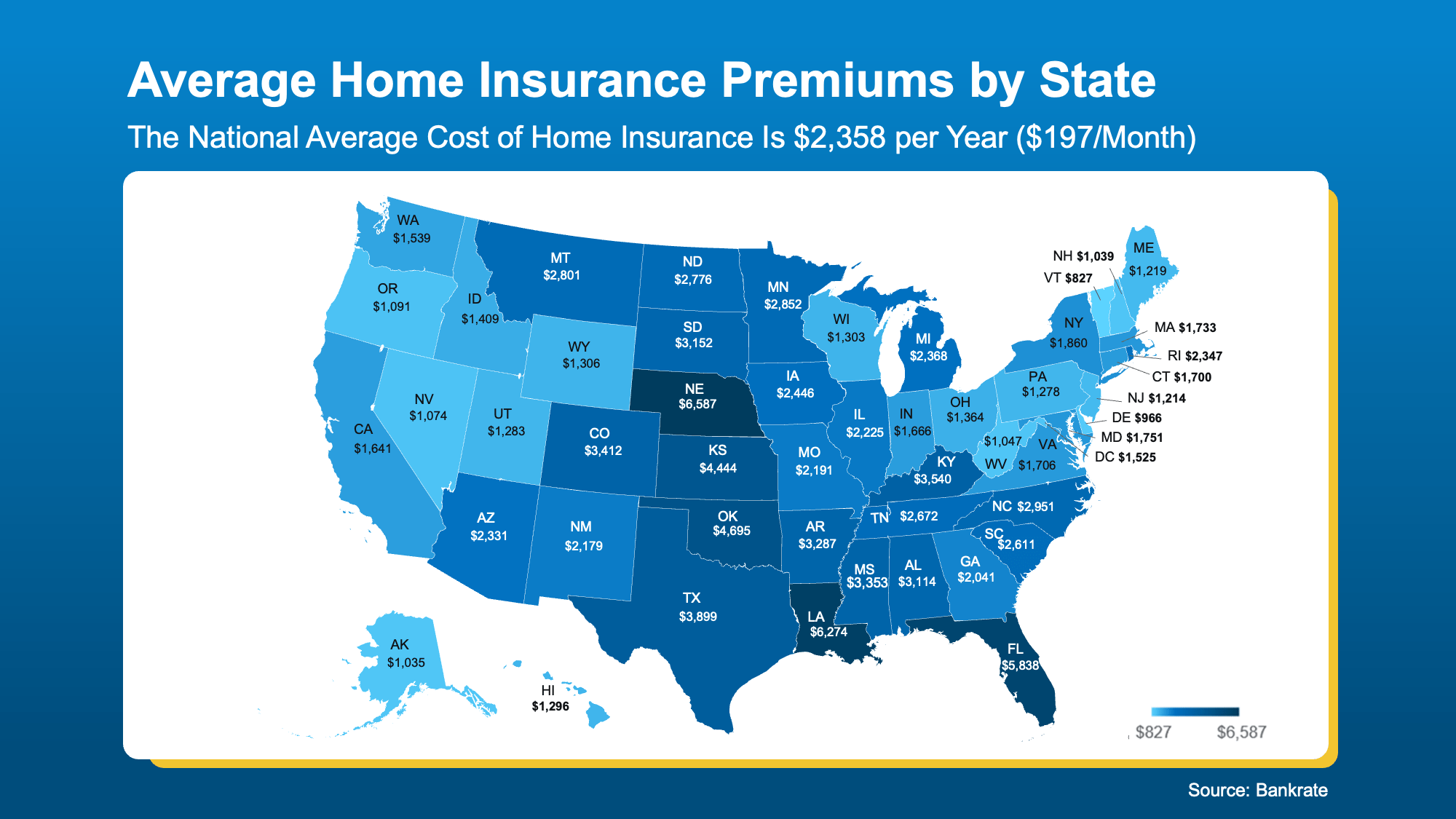

Home insurance premiums are not one-size-fits-all. Costs vary based on the home’s value, age, construction type, coverage limits, and—most importantly—location.

A home in coastal Sarasota may carry different insurance considerations than a property in Lakewood Ranch or inland areas of Manatee or Charlotte County. Local risk factors, including weather exposure and rebuilding costs, play a major role in pricing.

For most buyers, the first year of homeowner’s insurance is included in closing costs. After that, it becomes a recurring expense that must be planned for annually.

Knowing insurance premiums are rising helps buyers budget realistically and avoid surprises after closing. If you’re looking for ways to manage costs, Insurify and NerdWallet suggest several strategies:

Shop around by comparing quotes from multiple insurance providers

Bundle policies, such as home and auto insurance, to unlock discounts

Ask about available discounts you may qualify for

Highlight home upgrades, including newer roofs or storm-resistant features

Maintain strong credit, as better credit can lead to lower premiums

These steps can make a meaningful difference, especially in competitive Florida markets.

If you’re planning to buy a home in Sarasota, Lakewood Ranch, Manatee County, or Charlotte County, homeowner’s insurance should be part of your financial planning from the very beginning.

While insurance costs are rising, understanding what to expect and how to shop strategically can help you budget with confidence. This is one area where cutting corners rarely pays off, since insurance protects what is often your largest investment.

Thinking about buying a home in Sarasota or Lakewood Ranch and want help planning for the full cost of ownership?

Connect with Darren Dowling, Broker-Owner of Beyond Realty, for local guidance, market insight, and support through every step of the buying process.

Beyond Realty

2170 Main Street, Suite 103, Sarasota, FL 34237

941-204-0493

Darren Dowling is a Sarasota-based real estate broker-owner specializing in Sarasota and Lakewood Ranch residential real estate, new construction, and relocation.

What Sarasota, Lakewood Ranch, Manatee County, and Charlotte County Buyers Need to Know

Smart, data-driven strategies to help Sarasota homeowners and buyers make confident real estate decisions.

You’ve got questions and we can’t wait to answer them.