Mortgage Rates Hit Lowest Point So Far This Year – A Boost for Southwest Florida Homebuyers

Beyond Realty

Beyond Realty

If you’ve been holding off on buying a home in Southwest Florida, including Sarasota, Venice, and Lakewood Ranch, due to high mortgage rates, now might be the perfect time to take another look. Mortgage rates have been trending downward, opening a new window of opportunity for buyers.

For seven straight weeks, mortgage rates have been on a downward trajectory, according to Freddie Mac. The average weekly rate has now hit its lowest point this year, giving buyers a much-needed boost. (see graph below):

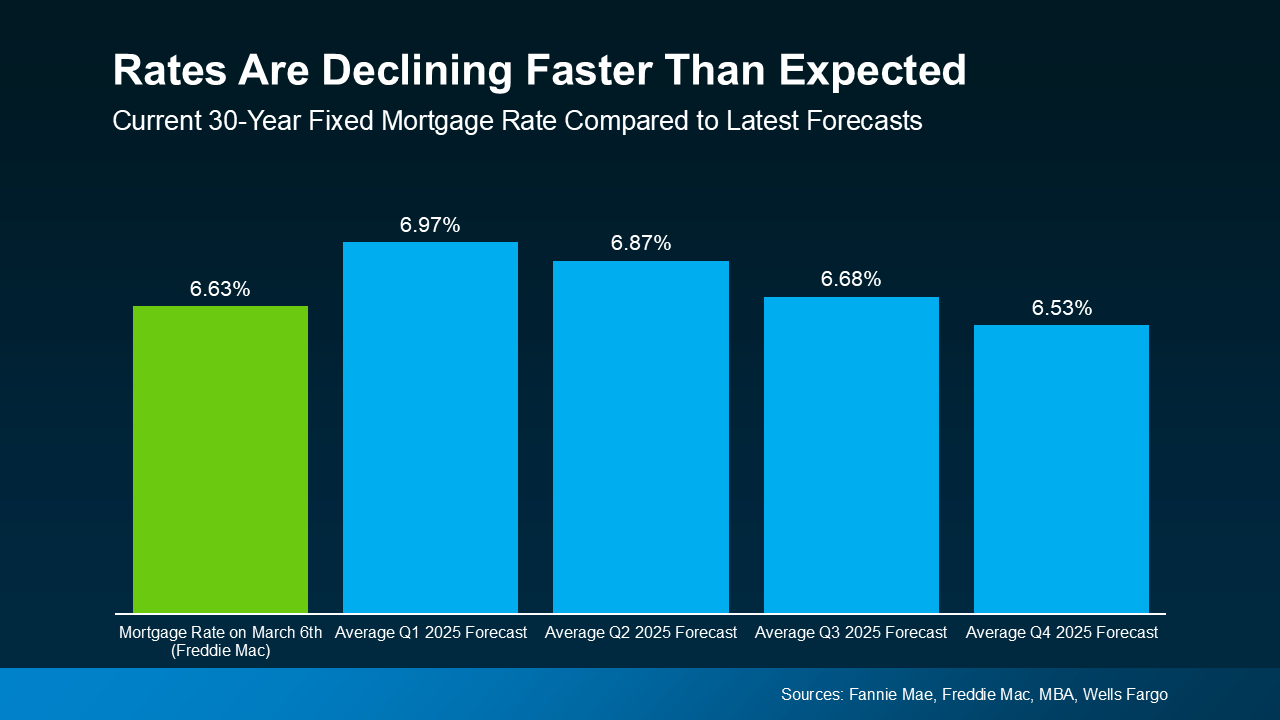

While this may seem like a small shift, the drop from over 7% to the mid-6% range is significant, particularly since forecasts previously suggested we wouldn’t see these rates until Q3 of this year.(see graph below):

According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), economic uncertainty has been a driving force behind the recent rate declines:

"Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024."

This drop is happening just in time for the spring market, which is great news for buyers in Sarasota, Venice, and Lakewood Ranch. However, keep in mind that mortgage rates are unpredictable and can shift quickly. Taking advantage of lower rates now could be key to maximizing your purchasing power.

Even a small rate change can significantly affect your monthly mortgage payment. Here’s an example of how recent rate declines impact affordability (see below):

A $400,000 home loan at 7.04% (mid-January’s peak rate) had an estimated monthly principal and interest payment significantly higher than what you’d pay today.

With rates now in the mid-6% range, buyers could see a monthly savings of over $100—a meaningful difference when budgeting for homeownership.

In a competitive real estate market like Southwest Florida, this shift makes homeownership more accessible and may even allow buyers to afford homes that were previously out of reach.

Economic conditions have pushed rates down faster than expected, but they can be volatile. If you’re waiting for rates to drop even further, you may miss out on this current opportunity. Acting now while rates are low could put you in the best position to secure the home you want in Sarasota, Venice, or Lakewood Ranch.

With mortgage rates at their lowest point this year, homebuyers in Southwest Florida have a unique opportunity to enter the market with more affordability. If you’re ready to explore your options, let’s break down the numbers and find the best fit for you.

Thinking about buying in Sarasota, Venice, or Lakewood Ranch? Reach out today to discuss how these lower rates can work in your favor!

Why Buying a Home in Sarasota or Lakewood Ranch Is About More Than Money

Your Home Didn’t Sell? Here’s How a Fresh Strategy Can Make All the Difference in Sarasota & Lakewood Ranch

Lifestyle, Beaches, Culture, and Real Estate Opportunities

A clear, data-driven look at home prices in Sarasota, Lakewood Ranch, Manatee County, and Charlotte County

Your Weekend Guide to Holiday Concerts, Theatre, Light Tours & Family Fun

Why Winter Can Be a Smart Buying Season in Sarasota, Lakewood Ranch, Manatee County, and Charlotte County

You’ve got questions and we can’t wait to answer them.