Mortgage Rates See Biggest Drop in a Year – What It Means for Sarasota, Lakewood Ranch, and Beyond

Darren Dowling

Darren Dowling

For months, buyers and sellers across Sarasota, Lakewood Ranch, and nearby Manatee and Charlotte Counties have been waiting for a meaningful shift in mortgage rates. Last week, it finally happened.

On Friday, September 5th, the average 30-year fixed mortgage rate fell to its lowest level since October 2024. According to industry reports, this was the biggest one-day drop in more than a year.

The decline was largely fueled by the August jobs report, which came in weaker than expected for the second month in a row. Financial markets quickly adjusted, and mortgage rates followed suit.

Historically, signs of a slowing economy often lead to lower borrowing costs. That’s what we’re seeing now — and it’s giving Sarasota and Lakewood Ranch homebuyers fresh opportunities.

This isn’t just another headline — it’s a chance to save real money on your next home.

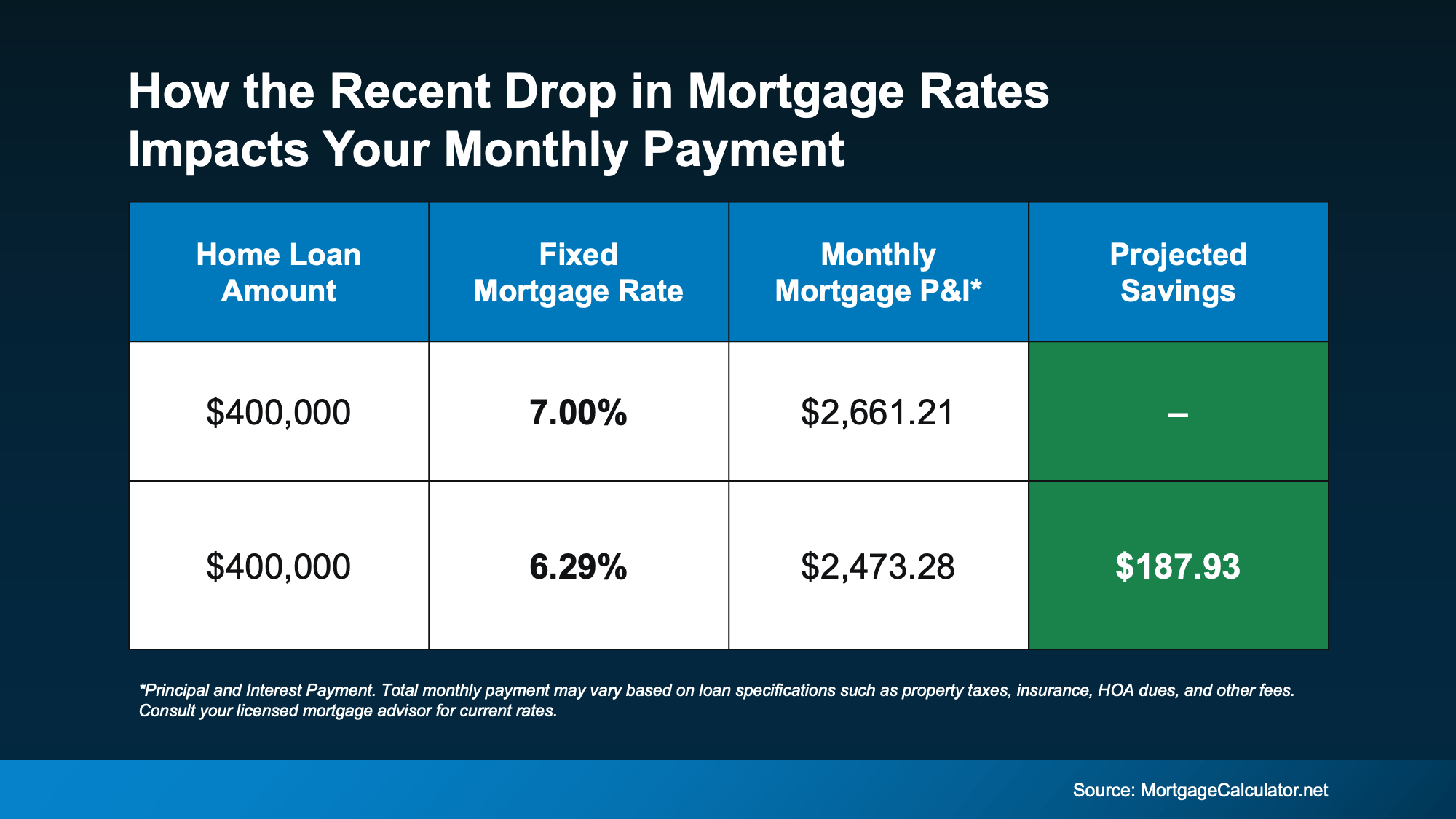

Take a look at the comparison showing the difference in monthly mortgage payments at 7% (common in May) versus today’s lower rates:

💡 On average, buyers could save nearly $200 a month — that’s close to $2,400 per year.

For many families across Sarasota, Lakewood Ranch, Bradenton, North Port, and Port Charlotte, that savings could be the difference between stretching the budget or comfortably affording the right home.

That depends on how the economy, inflation, and Federal Reserve policies evolve. Rates could drift even lower — or bounce back up slightly.

That’s why it’s crucial to stay connected with a local Sarasota or Lakewood Ranch real estate agent and a trusted lender. They’ll track market trends, Fed announcements, and job market updates to help you time your purchase wisely.

For now, the good news is simple: mortgage rates have broken out of their months-long rut. As CNBC’s Diana Olick put it:

“Rates are finally breaking out of the high 6% range, where they’ve been stuck for months.”

Mortgage rates just saw their biggest drop in a year — a change that could make your dream home more affordable.

Whether you’re considering a move to Sarasota, Lakewood Ranch, Bradenton, Venice, North Port, or Charlotte County, today’s market conditions are worth exploring.

Call Darren Dowling at Beyond Realty, (941) 204-0493, to see how today’s rates could change your monthly payment — and put you closer to the home you’ve been waiting for.

How to Take Advantage of Builder Incentives and Mortgage Rate Buydowns

A Complete Guide to Living, Working, and Investing in Lakewood Ranch

Lower rates could open new doors for homebuyers across Sarasota, Lakewood Ranch, Manatee, and Charlotte County.

A Local’s Guide to Sarasota’s Beloved Seafood Spot

Why Wellen Park is One of Florida’s Fastest-Growing Master-Planned Communities

You’ve got questions and we can’t wait to answer them.