Navigating Mortgage Rate Fluctuations in Southwest Florida Real Estate

Beyond Realty

Beyond Realty

If you’ve been following the mortgage market lately, you’ve probably noticed rates feel like they’re on a roller coaster. One day they dip, the next they climb again—making it tough to know when to take the leap into homeownership, especially here in Sarasota, Lakewood Ranch, and Venice where the real estate market is always in motion.

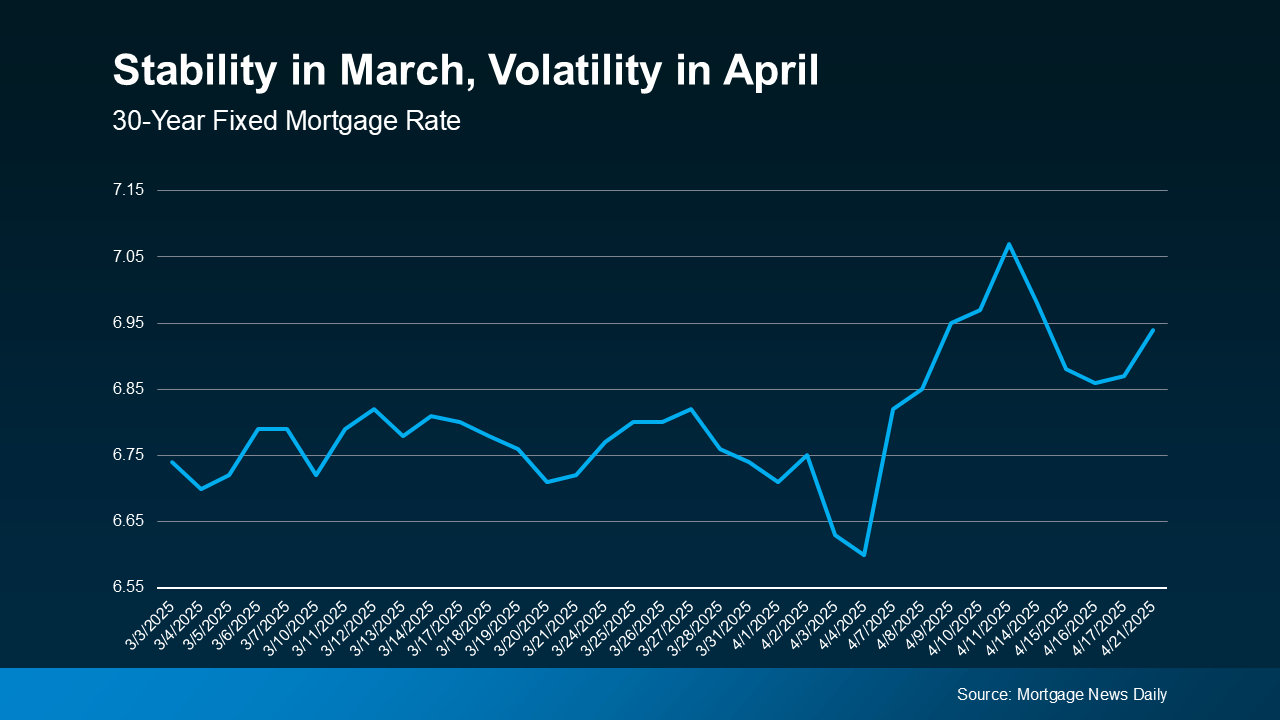

📉📈 Just take a look at recent data from Mortgage News Daily. After a fairly stable March, April brought notable rate volatility. This kind of movement is common when broader economic shifts are happening, and it’s something we’ve seen before.

But here’s the truth: trying to time the market isn’t a winning strategy. Mortgage rates are unpredictable, and no one can forecast them with 100% accuracy. The good news? You’re not without options.

Even in a fluctuating market, there are steps you can take to position yourself for the best rate possible.

Your credit score plays a huge role in determining what rate you qualify for. According to Bankrate:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

Improving your credit score—even slightly—can translate into a lower monthly payment and long-term savings. If you’re unsure where your credit stands or how to raise it, consult with a trusted local loan officer.

In Southwest Florida, buyers have access to various loan products—including conventional, FHA, VA, and USDA loans. Each type comes with its own eligibility criteria and rate structures.

As the Consumer Financial Protection Bureau explains:

“Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

Working with an experienced mortgage professional will help you identify which loan fits your goals and financial situation best—especially in popular and diverse markets like Sarasota, Lakewood Ranch, and Venice.

Beyond the type of loan, the term length—typically 15, 20, or 30 years—can greatly impact your monthly payment and total interest paid.

Freddie Mac notes:

“Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

A shorter term usually means a lower interest rate, but a higher monthly payment. Discuss the pros and cons with your lender to find the right balance.

You can’t predict mortgage rates—but you can prepare yourself to make a smart move when the time is right.

If you’re thinking about buying in Sarasota, Lakewood Ranch, or Venice, let’s connect. I’ll help you navigate the process, recommend trusted lenders, and get you closer to owning a home in the heart of Southwest Florida.

📲 Ready to start? Reach out today—we’re here to help you make informed, confident decisions in any market.

What Buyers and Sellers in Sarasota, Lakewood Ranch, Manatee, and Charlotte Counties Need to Know

Why Buying a Home in Sarasota or Lakewood Ranch Is About More Than Money

Your Home Didn’t Sell? Here’s How a Fresh Strategy Can Make All the Difference in Sarasota & Lakewood Ranch

Lifestyle, Beaches, Culture, and Real Estate Opportunities

A clear, data-driven look at home prices in Sarasota, Lakewood Ranch, Manatee County, and Charlotte County

Your Weekend Guide to Holiday Concerts, Theatre, Light Tours & Family Fun

You’ve got questions and we can’t wait to answer them.