Sarasota Housing Market Forecast for the Rest of 2025

If you’ve been following the Sarasota or Lakewood Ranch housing market, you’ve likely noticed some shifts already this year. So, what’s next for home prices and mortgage rates as we move through the rest of 2025? Here's what the latest expert projections mean for homebuyers and sellers across Sarasota, Manatee, and Charlotte Counties.

Many buyers in Southwest Florida are hoping home prices will fall soon. With news headlines hinting at slight dips in some markets, there’s growing curiosity about whether a bigger price drop is on the horizon. But the reality looks different—especially for Sarasota and Manatee County real estate.

While price growth has slowed compared to the record-setting pace of the last few years, a major decline is not expected. As noted by the National Association of Home Builders (NAHB):

“House price growth slowed . . . partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on house prices.”

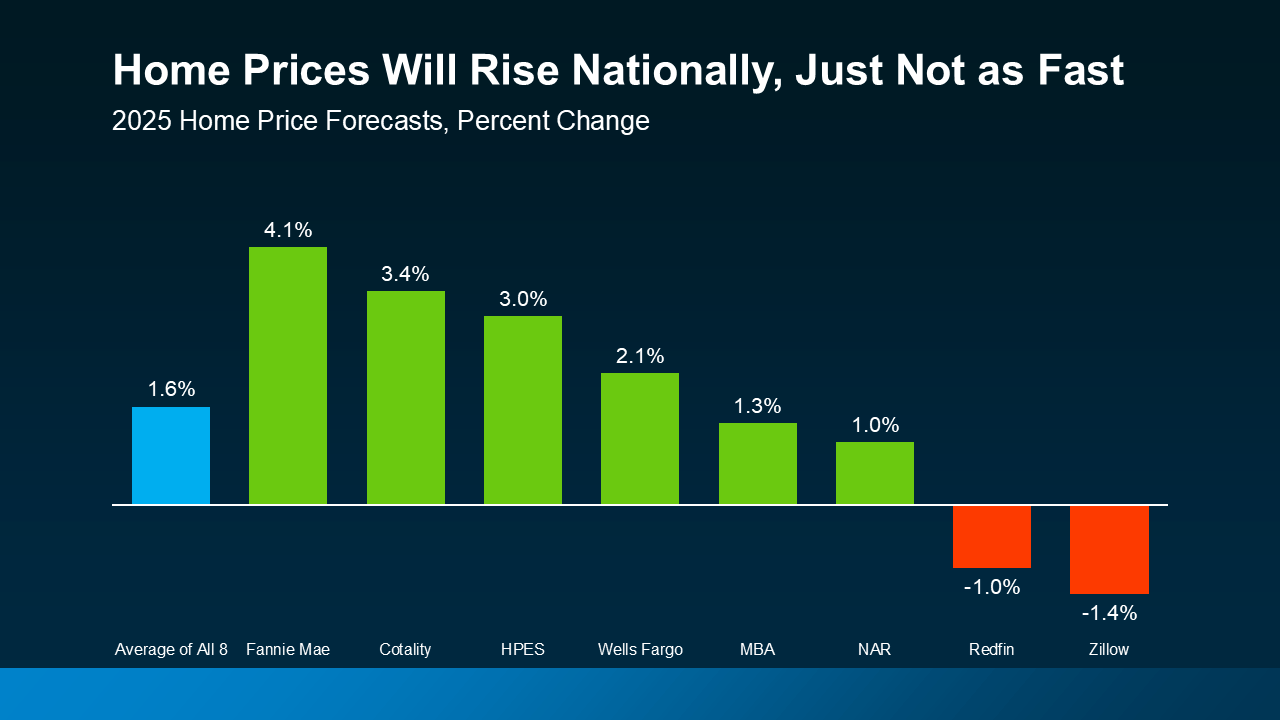

Even with this cooling, most economists expect home values to continue rising modestly through the end of 2025. The average from leading analysts shows an estimated 1.5% to 2% increase in home prices nationally. (see graph below):

In Sarasota, Lakewood Ranch, and across Manatee and Charlotte Counties, this trend is expected to hold—especially in sought-after neighborhoods where demand remains steady. While isolated areas may see a slight softening (about -3.5% in some national examples), this is nowhere near the crash levels seen in 2008.

Homes in the region have appreciated substantially in the past five years—up nearly 55% in some cases—so a slight leveling off is a normal part of the cycle.

Bottom line: If you’re waiting for a big drop in Sarasota home prices, you may be waiting too long. A local real estate expert can help you interpret trends specific to your neighborhood or desired community. (see chart below):

Another common question from buyers in Charlotte and Manatee Counties is: Should I wait for mortgage rates to fall?

According to Yahoo Finance, that strategy could backfire:

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting. The latest news from the Federal Reserve and other key economic data point toward steady mortgage rates on par with what we see today.”

Translation: mortgage rates aren’t expected to drop significantly. Most forecasts point to average rates hovering in the mid-6% range, possibly ending the year just slightly lower than where they began.

In markets like Sarasota and Lakewood Ranch, waiting could cost you more—especially if home values continue to rise. Rather than hoping for a dip that may not come, it’s smarter to work with a local agent who can help you explore loan programs, negotiate better terms, and time your purchase wisely.

Whether you’re buying your first home in Lakewood Ranch, moving up to a larger property in Sarasota, or selling a house in Charlotte County, you need a clear strategy—not just headlines.

Buyers should focus on affordability and long-term value rather than trying to time the perfect rate.

Sellers can still capitalize on a healthy, stable market—especially when pricing competitively and marketing effectively.

The market isn’t crashing. It’s normalizing. That means opportunities still exist—especially when you’re working with an expert who understands the local Sarasota-Manatee-Charlotte landscape.

Real estate is hyperlocal, and Sarasota’s market is no exception. National headlines don’t always reflect what’s happening in Lakewood Ranch or downtown Sarasota. If you’re thinking of making a move in 2025, focus on your personal goals, current lifestyle needs, and work with someone who knows our region inside and out.

Let’s connect to discuss how today’s trends in Sarasota, Lakewood Ranch, and surrounding counties impact your unique situation—and how to plan your next move with confidence.

A Look Ahead for Lakewood Ranch, Manatee & Charlotte County Homeowners and Buyers

Whether you’re new to the area or just visiting, these underrated spots showcase the best of Florida’s quiet coast.

Don’t Believe the Headlines: Foreclosure Activity in Sarasota and Surrounding Counties Remains Historically Low

With builder incentives, modern designs, and mortgage rate buy-downs, now is a smart time to go new.

A local guide to navigating the Sarasota, Manatee, and Charlotte County housing markets with confidence and clarity.

You’ve got questions and we can’t wait to answer them.