Why Would I Move with a 3% Mortgage Rate? A Southwest Florida Perspective

Beyond Realty

Beyond Realty

If you're one of the many homeowners in Sarasota, Lakewood Ranch, or Venice sitting on a 3% mortgage rate, the thought of moving might feel a little irrational — even risky. You’ve likely asked yourself: Why would I give up such a low rate?

But here’s the truth: most people don’t move because of their mortgage rate. They move because their life changes — and their home no longer fits the season they’re in.

Take a moment to imagine your life over the next five years.

Are you planning to grow your family?

Are your kids preparing to leave the nest?

Are you approaching retirement and looking for a lifestyle change?

Are you simply outgrowing your current space?

If your answer to any of those questions leans toward change, then it may be time to reconsider your timeline. Because while your low mortgage rate is certainly a financial advantage, it shouldn’t outweigh your evolving needs.

In real estate — especially here in Southwest Florida — timing is everything. (see graph below):

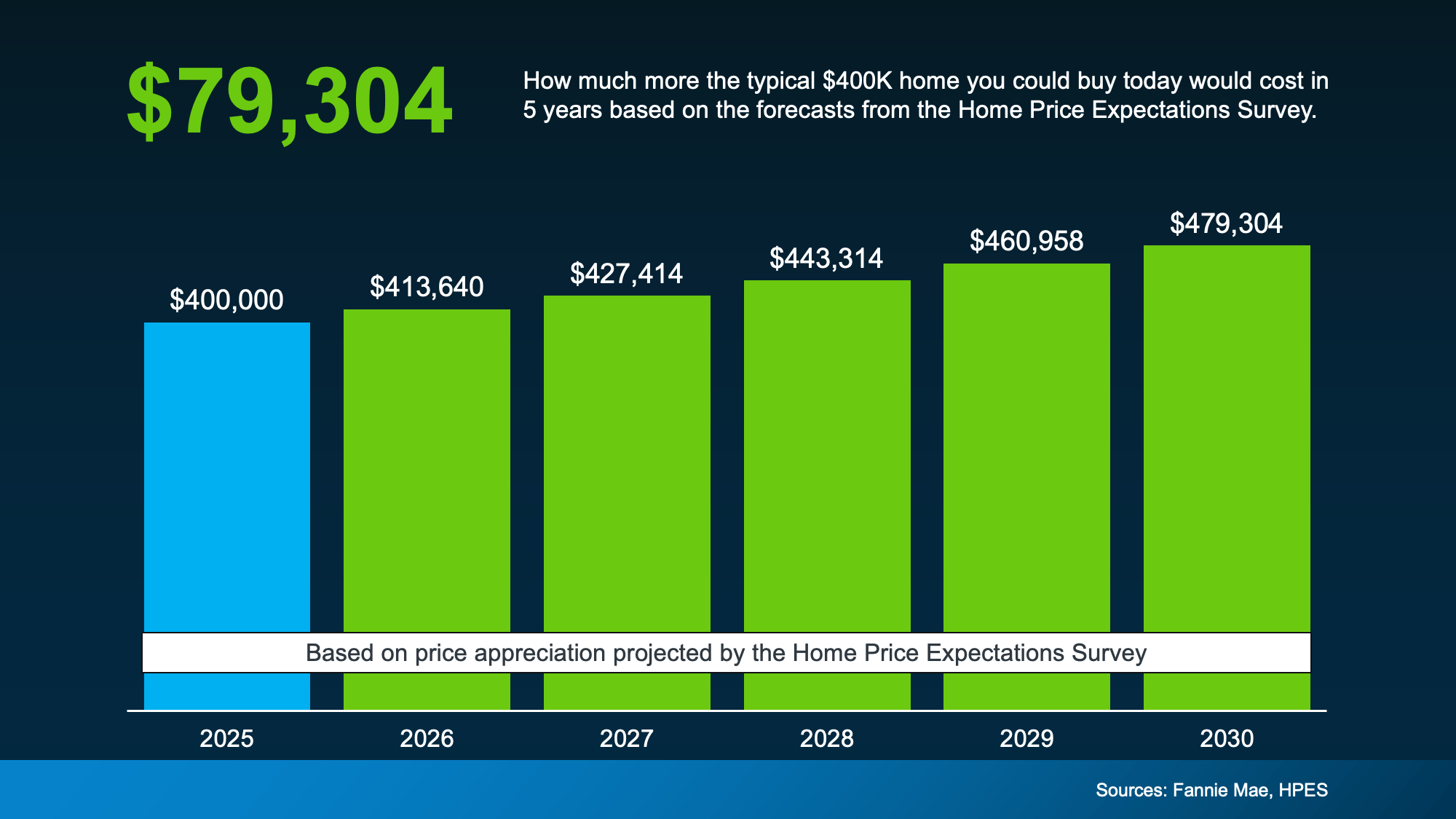

Each quarter, over 100 housing market experts weigh in through Fannie Mae on where home prices are headed. The consensus? Prices are projected to continue rising steadily through 2029.

Even in desirable markets like Sarasota, Lakewood Ranch, and Venice, where we've seen strong growth over the past few years, home values are still expected to appreciate — just at a more modest pace. That means waiting to buy your next home could cost you significantly more down the road.

Let’s say you're eyeing a $400,000 home today. If projections hold, that same home could cost nearly $480,000 in just five years. That’s $80,000 more — and that increase compounds if you're also factoring in higher property taxes and insurance premiums that come with rising values. (see graph below):

It’s true — mortgage rates aren’t what they were a few years ago. But experts agree: we’re unlikely to see 3% rates again anytime soon. While moderate rate reductions are expected, holding out for that magic number could mean missing the window to make a move that actually works for your life and your finances.

Waiting for the “perfect” rate might end up costing more in the long run than taking action now at a slightly higher rate — especially if home prices continue their upward climb. (see graph below):

So instead of asking “Why would I move?” — start asking “When should I?” The longer you wait, the more your future home might cost. That’s why now is the ideal time to speak with a trusted real estate expert who understands the local market and can help you run the numbers.

Whether you're considering a move to a new construction home in Lakewood Ranch, a coastal retreat in Venice, or a lifestyle shift within the heart of Sarasota, planning ahead can help you move forward with confidence.

Bottom Line:

That 3% mortgage rate served you well — but don’t let it be the reason you miss out on a better-fitting future.

If a move is even remotely on your horizon, let’s sit down and go through the numbers together. I’ll show you what your next steps could look like here in Southwest Florida and help you make an informed decision — not just for today, but for the years ahead.

Have a specific price point or neighborhood in mind? Let's talk about how that fits into your plan.

Your Guide to Holiday Lights, Music, Fitness & a Magical Boat Parade Across the Suncoast

Lifestyle, Healthcare, Tax Benefits & Top Retirement Communities

Winter Selling in Sarasota & Lakewood Ranch: How Less Competition and Motivated Buyers Work in Your Favor

A 2026 Guide to New Construction Opportunities Across Sarasota, Lakewood Ranch, Manatee County & Charlotte County

You’ve got questions and we can’t wait to answer them.