Waiting for a Recession To Buy or Sell a Home in Sarasota? Here’s What You Need To Know

Darren Dowling

Darren Dowling

If you’re thinking about buying or selling a home in Sarasota, Lakewood Ranch, or anywhere in Manatee or Charlotte County, you’ve probably seen the headlines: “Is a recession coming?”

And with that comes a big question for many homebuyers and sellers in Southwest Florida:

Should I wait to make a move until after a recession hits?

A recent joint survey from John Burns Research and Consulting and Keeping Current Matters found that 68% of people are postponing their real estate plans due to economic uncertainty.

But interestingly, not all of them are fearful — some are optimistic.

According to Realtor.com:

“In 2025 Q1, 29.8% of surveyed homebuyers said a recession would make them more likely to purchase a home.”

Why? Many buyers believe that if the economy slows down, mortgage rates might drop, making homes more affordable. It’s true that historically, rates tend to dip during economic slowdowns. In fact, in all six of the last U.S. recessions, mortgage rates declined — giving buyers more room in their budget. (see graph below):

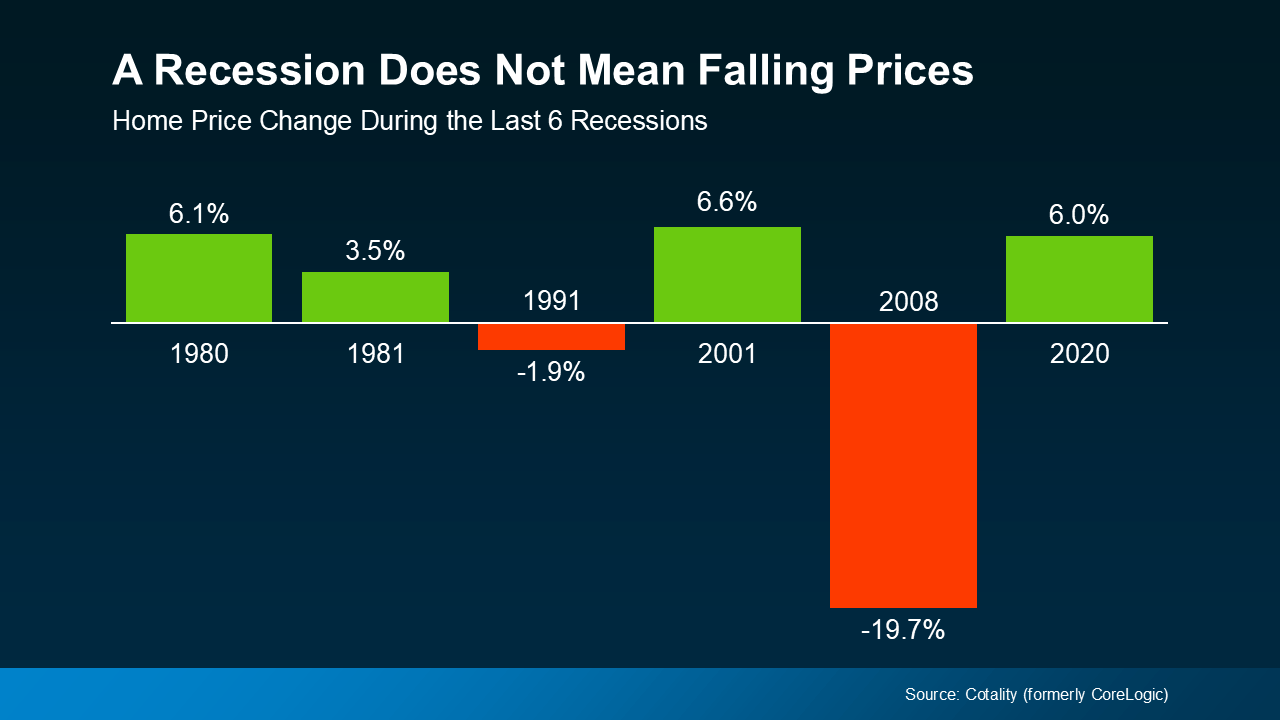

Here’s where expectations and reality often part ways. Many hopeful buyers assume that a recession will cause home prices to fall — but history paints a different picture.

According to Cotality (formerly CoreLogic), home prices actually increased during four of the last six recessions. The one major exception? The 2008 housing crash — which was caused by a mortgage crisis, not a typical economic slowdown. (see graph below)

In markets like Sarasota, Lakewood Ranch, and throughout Manatee and Charlotte Counties, demand continues to outpace supply. Even as more inventory hits the market, Florida is still facing a long-term housing shortage, which helps keep prices stable or rising — even in uncertain economic conditions.

As Robert Frick, Corporate Economist at Navy Federal Credit Union, explains:

“Hopes that an economic slowdown will depress housing prices are wishful thinking at this point.”

If you’re waiting for both lower mortgage rates and lower home prices, you could be waiting a long time.

Here’s the likely scenario:

Mortgage rates may go down slightly during a slowdown.

Home prices will likely stay steady or rise due to strong buyer demand and limited supply.

The danger? If rates go down but more buyers flood the market, competition increases, pushing prices even higher and wiping out any gains from rate reductions.

If you’re planning a move in Sarasota, Lakewood Ranch, or the Manatee/Charlotte County area, don’t let recession headlines freeze your plans.

While lower interest rates may be on the horizon, falling prices are highly unlikely in this high-demand Florida market. The smart move is to understand local market trends and plan accordingly — not wait for a scenario that may never come.

Let’s connect to talk about your goals and make a strategy that works for you — regardless of what the headlines say.

Whether you're a first-time buyer or relocating, this guide will walk you through the process of buying in Florida’s #1 master-planned community.

Explore Downtown Sarasota: Vibrant Arts, Culture & Events in Sarasota, Manatee & Charlotte Counties

Sarasota, Lakewood Ranch, and Beyond: Navigating Real Estate in Today’s Split Market

A peaceful small-town feel with big-time potential—Parrish offers affordability, space, and convenience near Sarasota and Tampa.

A Look Ahead for Lakewood Ranch, Manatee & Charlotte County Homeowners and Buyers

You’ve got questions and we can’t wait to answer them.